Stock Buybacks (Again)

Posted by simonposullivan in Equities on October 6, 2014

This morning there is a story on Bloomberg highlighting that US companies will spend 95% of their profits ($914 billion) on share buybacks and dividends – see my recent posts here and here for more. This is financial engineering gone mad and is not good for the US industrial base and therefore the US economy longer term. I read too this morning that corporates in the US are on track this year to issue $1 trillion (a new record) in corporate debt.

Combine borrowing to buy shares with historically lousy market timing and you have a recipe for disaster.

Demographics

Posted by simonposullivan in Japan on October 1, 2014

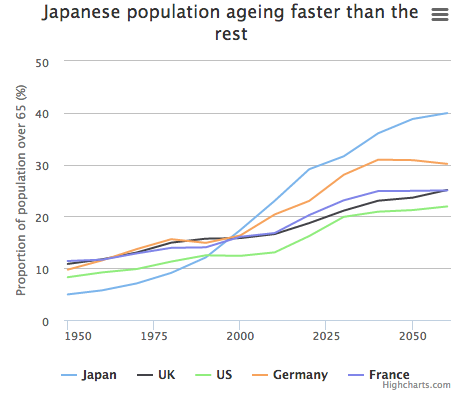

As I’ve commented on before Japan has a real problem – its citizens are aging quickly – see chart below via Chris Bailey. This means 1) their tax revenue falls at the same time as 2) the retirees begin drawing pensions either privately or from the state welfare system. Not a good combination for one of the most indebted nations on the planet – Japanese debt is one QUADRILLION yen with a large and growing deficit. I fear John Mauldin is correct when he says Japan “is a bug in search of a windshield“.

Share buybacks

Posted by simonposullivan in Equities on September 25, 2014

Interesting chart via John Hussman demonstrating how useless corporate executives are in aggregate at timing sharebuybacks (see my recent post here). Note how they peaked in 2007 before the financial world imploded and then dropped to a trickle as markets were bottoming out. They are now rising very sharply as markets become more and more expensive. As Hussman says “Given that the majority of corporate debt issuance is shorter than 8 years, and we estimate nominal S&P 500 total returns to be negative at that and shorter horizons (with our estimates rising to just 1.5% annually on a 10-year horizon), my view is that issuing corporate debt to repurchase equity presently represents value destruction, and also weakens corporate balance sheets.”

Furthermore and what is very worrying is that corporate executives are selling like there is no tomorrow. Wolf Richter says here “Only 7,181 insiders bought shares of their own companies so far this year through September 12, down 8% from a year ago, while 23,323 sold shares, according to Bloomberg – approaching the worst buy-sell ratio since 2000.”

So corporate are doing one thing with their own money and quite a different thing with OPM (Other Peoples Money). Quelle surprise

Idiotic+Minister=Ireland

Posted by simonposullivan in Ireland on September 11, 2014

Clearly one of the most idiotic and stupid things a minister can say (he did say “hopes” but still pretty brainless).

h/t Sean Tuffy,BBH

Volatility

Posted by simonposullivan in Economics on September 9, 2014

Volatility has been crushed – largely by central Bank manipulation via QE (FED has your back, Greenspan\Bernanke\Yellen Put etc). The chart below is not a long term chart so hard to see correlations overtime but is something up as FX spiking sharply?

h/t Zerohedge

Central Banks and Liquidity

Posted by simonposullivan in Economics on September 8, 2014

This is a fairly mind blowing chart – even by the standards of Zerohedge:

when this will end nobody knows……

Irish Property

Posted by simonposullivan in Ireland on September 3, 2014

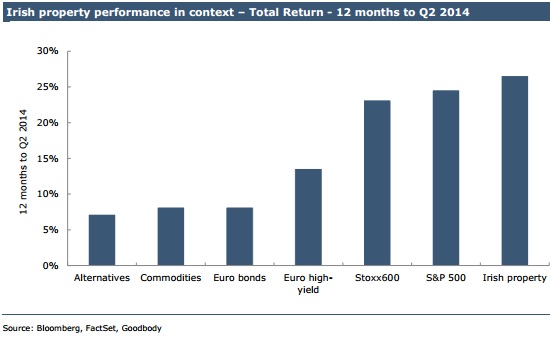

I’m the first to admit I’ve called the S&P wrong (at least so far) this year. At least I put my money where my mouth was by going (very) long Irish property early in 2013. So far that’s working out – according to the chart below from Goodbody. Can this last is the question? There is certainly a feeding frenzy into Irish property at the moment driven initially by distressed debt investors (hedge funds) and cash buyers, now morphing into demand from Irish buyers (some with mortgages, some indirectly via the REITS). Goodbody point out, and I’d agree that we have not seen a supply reaction – no real house building is going on and it’s a similar picture in the commercial office sector. For now with government bond yields so low Irish property looks great by comparison. So long as this (desperate) hunt for yields continues and the supply shortages keeps rents rising then prices can keep rising. A rise in rates (which looks unlikely admittedly) would obviously derail this. Perhaps simply prices will reach a level where yields don’t compare so favourably with government bond yields and a sell off begins. So we need to watch this carefully – property is incredibly illiquid so you need to be out early.

Japan’s lost decade

Posted by simonposullivan in Japan on August 30, 2014

Peter St.Ongs (of Mises.org) points out in an interesting piece that when measured by GDP per capita Japan actually hasn’t done any worse than the US. The reason commentators say Japan has done so badly in comparison with the US is that they begin the measurement period in 1990 just as Japan was peaking and the US began its technology revolution:

Japan had a bubble in the 1980’s which then burst and the US had its bubble in the 1990’s and early 2000’s which burst around 2007/2008.

Still that said I think Japan long term is screwed by a combination of debt and unfavourable demographics see here, here and here for example.

S&P 500

Posted by simonposullivan in Equities on August 25, 2014

With the S&P 500 hitting an intraday record high of 2000 (why2k?) I think the following chart is very interesting:

I was on holidays for a few weeks in August and was amazed how upset commentators seemed to be about a 3.94% drop in the stock market. I guess extreme complacency is the only way to describe things when a 4% move in the stock market gets some people worked up. The chart neatly shows how markets have been moving in more or less a straight line and the volatility has been shrinking (a lot of people struggle with vol and standard deviation but the chart clearly shows the tightness of the spread around the markets average – which is largely a straight line from bottom left to top right). At some stage normality will resume but as I have been saying for well over a year on these pages nobody, least of all me, knows when nor what will trigger this event. Most people seem to think the status quo will remain in place for many years to come – when the majority thinks one thing the opposite is likely to happen!

Stock Buybacks

Posted by simonposullivan in Equities on July 23, 2014

Its getting quite ridiculous: its far easier for corporate executives to simply borrow at these low rates and just buy in their stocks (eps accretive thus good for the share price and therefore their stock options) rather than make tricky decisions such as perhaps investing, you know, for the future etc. Taking on a capital project involves a bit of work and possibly a lot of risk. Borrowing money knowing you won’t be at the helm when it has to be paid back is easy.

Gordon T Long has some interesting charts:

90% of all S&P 500 profits are presently being spent on corporate Buybacks and Dividends. This is historically unheard of.