Bubblicious

Posted by simonposullivan in Uncategorized on October 6, 2017

I havent written a post on the blog for a couple of years but have been contributing in my own small way to the blogsphere via Linkedin (https://www.linkedin.com/in/simon-o-sullivan-7b31a64/) and Twitter (@AIFRiskSystem) so I thought it was time I wrote a post around current markets and possible a bubble environment.

This morning I saw a post written by Mohammed El-Erian, one of the smartest thinkers on the markets around, that got me thinking. And trust me, I know my limits, I am reluctant to ever disagree with Mohammed. However commenting in an article from the Wall Street Journal Mohammed stated that it “would take a major shock/series of shocks to derail such deep investor conditioning regarding the support and backstop for asset prices — and this notwithstanding relatively rich valuations.” I am not so sure. For starters the line in the article that really caught my attention was “Investors don’t see many worries ahead”. And I guess that is fundamentally the problem.

A rich market can always get richer – and it’s a sure fire way of going broke – shorting an over-valued market that just keeps going up. Speculators often get carried out on a stretcher betting on mean-reversion. I think this is what Mohamed is getting at, yet he appreciates markets are “rich”. So is it time to hit the exit?

No-one, and I mean no-one, knows for sure. I have a strong feeling that the exit isn’t going to be a door – its going to be a cat-flap. The increase in technology, the trend to passive investing and ETFs and the pervasiveness of 24/7 news and social media means the average investor is far more informed than ever before and consequently will react to price falls faster. What this may mean is everyone will head for the door at the same time – and the computers will just sell anything and everything that they can (everything that is “liquid” that is). As soon as they start there could be a self-reinforcing downward spiral as the markets gaps down as it sails through various air-pockets (the old stock market cliche that markets go up the steps but down the lift-shaft).

So what might start this process? Firstly everybody (not literally, but a good sized majority) need to be “in”. In other words when most people are bullish, fully invested and believing nothing can go wrong (“the Fed has our back”). As an example I recall as a fund manger in the City of London in 1999 at the height of the dot.com craze, quite literally, I could not get in the door of investment conferences when fund managers who ran technology funds were presenting. It was simply nuts – with a capital bonkers. Are we there yet? damned if I know but we’re certainly another step closer every day.

Secondly per Mohammeds’ point we need a catalyst. I’ve thought a lot about what this might be – the obvious ones are geo-political or the Fed raising rates – maybe even an inflationary spike (inflation – remember that? quaint really). However it might simply be a buying frenzy that fizzles out. Again I recall that the peak in the Nasdaq in March 2000 wasn’t apparent until a few months later. There was some fairly savage sector rotation for a few months in what turned out to be, in hindsight, the peak as participants tried to keep the party going (“keep dancing” a la Chuck Prince). In hindsight there wasnt actually any catalyst – markets just began to doubt that all tech companies could be as wildly profitable as they were forecasting (they weren’t so much forecasting the future as the hereafter). Valuations were stretched and mean reversion began to kick in.

I have a sneaking suspicion, nay a terrible fear, that the weight of debt around the world will catch up with us. According to Kyle Bass China has $40 trillion of debt! Yes forty trillion. That number is simply staggering. Ok Japan owes a quadrillion yen but hey that’s yen! In Kyle’s view it is “is the largest global imbalance I’ve ever seen in my life.” Scary he’s three months younger than me and we’re both short of fifty (just) so we haven’t seen it all. But we both read a lot (its clearly paid off more for Kyle than me – I don’t have the ranch etc.). If you don’t learn from history you are doomed to repeat it (sadly the world hasn’t learned a lot form the 2008 experience).

Anyway just for fun here are a couple of bubblicious pics:

This next chart is a graph of the Swiss central bank (which is actually quoted)

US consumers are pretty bullish:

Meanwhile the central banks are looking for the door….

Happy Hunting!

Shale Oil – not all its fracked up to be

Posted by simonposullivan in US Economy on January 29, 2015

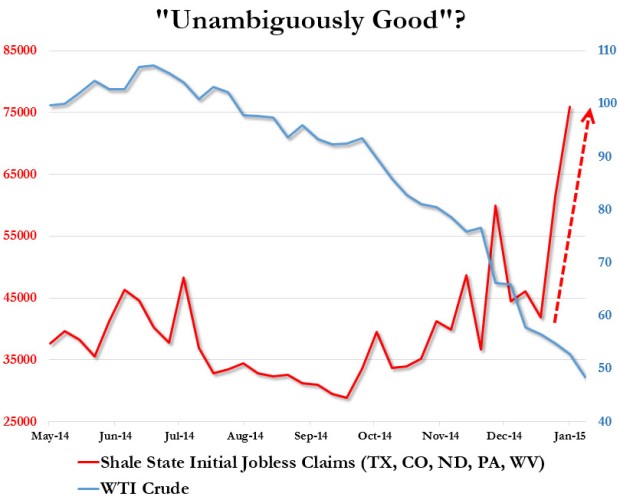

I’ve written before about how I thought shale oil was probably overrated – see here and here. The high cost of shale extraction and also the high cost of replacement means much of the fracking industry will not be viable at a $50 oil price. However there is a major political upside to the US being self sufficient ad not being forced to by oil from regimes they don’t particulalry like so perhaps there will be subventions etc to offset this in the future. The other thing is that hundreds of billions fo dollars has gone into the energy high yield (aka junk) market – mcuh of this has vaporized in the last few months. Many jobs are going the same way as the chart below shows:

h/t Zerohedge

High Yield and Energy

Posted by simonposullivan in Economics on January 7, 2015

Back in May I wondered if the shale boom could be a mirage (see here). It seems it may well be and judging by this chart a lot of the (hot) money that went into this space is going to get dissolved. Oil is down roughly 56% since June (you can see the real losers here – Canadian oil sands companies are slightly worse than the shale oil producers in terms of average cost of extracting a barrel of oil.) The number of rigs is also collapsing (see wolf) as companies try to stem the cash outflow. One of the quirks of the oil market is that some countries actually increase production as the oil price falls (as they need to produce more oil at the lower price to meet their budgetary commitments). More supply means more falls in prices leads to more production – seems odd and it is. Welcome to the whacky world of oil.

I have a scary feeling the collapse in oil could be the canary in the coal mine – steel prices are falling leading to shuttered steel mines and so on. Could be tin hats on soon (at least they ought to be getting cheaper!).

Oil

Posted by simonposullivan in Economics on December 22, 2014

Fascinating chart showing the breakeven costs of oil. Canada looks in trouble on this chart and you can see why the Saudis are so comfortable letting the oil price collapse – hurts US shale industry which has the second highest cost price and Russia too.

Source:FT

Emerging Markets

Posted by simonposullivan in Economics on December 19, 2014

It has been a wild ride the last few weeks with oil collapsing and Russia facing a serious recession as the currency has collapsed. The following chart shows how serious this crisis has been. I had hypothesised here that Saudi Arabia was helping the US to get the oil price down to hurt Russia. It undoubtedly did so but perhaps I was wrong (or half right) – perhaps the Saudis want to hurt the US shale oil industry while they are at it? if this EM crisis continues things could get interesting, very interesting…..

Japan and Europe

Posted by simonposullivan in Economics on December 2, 2014

Simply been too busy in my day job to blog. This chart caught my eye. I’ve been thinking about the “Japanification of Europe” for a while now. Ten or twenty years of stagnation and deflation as global deleveraging and unwinding of the excesses built up pre-2008. Hopefully not but the bond market is starting to buy this theory.

Oil

Posted by simonposullivan in Economics on October 16, 2014

Found the chart that proves Saudis dumping discounting oil (to help US Vs Russia is my theory).

A 20% fall in oil has two effects. The first is it boosts GDP as input costs are lower but the other effect is knocks approximately 0.5% of global CPI. When the world is worried about deflation this may not be a good thing….

Start Ups

Posted by simonposullivan in Uncategorized on October 10, 2014

Market Correction

Posted by simonposullivan in Equities on October 10, 2014

I liked this (h/t Alex Tarhini)

What to Do During a Market Correction

Hedge Fund Managers:

- Let clients know that you saw this coming and that of course you are hedged

- Yell at the nearest trader to f*cking hedge the book

Stock Brokers:

- Call everyone on your CRM that you have ever told to short a stock

- Avoid calls from the clients who you told to buy stocks last week

Financial Journalists:

- Over analyze anything that can be spun as a reason for the market to sell off

- Deadly viruses typically work here

Dentist / part-time e-traders:

- Panic into complex option positions that your wife will never understand

- Yell at your kids about your damn theta burn

Financial Advisors:

- As a fiduciary, it is your responsibility use this time to sell the most active, high-fee funds you can get your hands on.

- Remind Mrs. Jones, you don’t know where the next 20% move is, but you do know where the next 100% move is.

Economists:

- Go on CNBC and make it clear that you are right about something

- Tell yourself how awesome you are

Day Traders

- Remember the “good years” when the VIX was at 90 and the economy was collapsing

- Realize that isn’t happening and that HFT just scalped you again and you have no idea why you’re still doing this

Newsletter Authors:

- Email blast that bearish note you wrote in July of 2013

- Write a “what to do now” email behind a paywall with a 15% discount, type “bear” in promotion box.