Posts Tagged QE

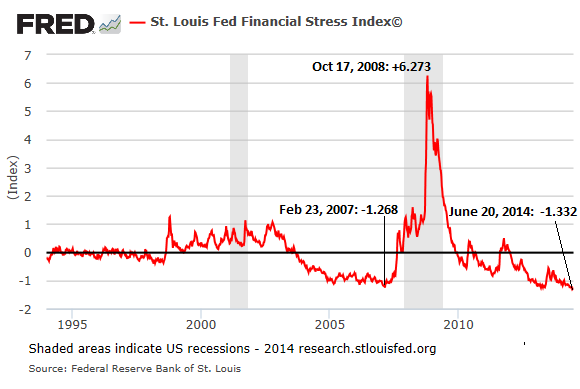

Financial Stress (or not)

Posted by simonposullivan in Economics on June 27, 2014

At 2007 lows again – nothing to see here, keep moving on please…..

Aggregate VaR has dropped significantly since the end of the financial crisis at the five largest U.S. banking companies with trading operations. While some of the VaR decline is a result of lower client activity and reduced bank trading risk appetite, the low-volatility environment is the primary cause of lower VaR. In a more normal volatility environment, one without sustained monetary policy accommodation by the Federal Reserve, bank VaR would be meaningfully higher. Thus, current VaR calculations may understate trading risk in the banking system.

The above is from the the Office of the Comptroller of the Currency

Syndicated leveraged loan issuance reached a record high in 2013 as the search for yield in the low interest rate environment drove an increase in risk appetite across institutional investors such as collateralized loan obligations (CLO) and retail loan funds.

Don’t these guys at St Louis Fed and OCC talk to each other?

A record $258 billion of these new covenant-lite loans are issued last year. Not just a record, but “nearly equal to the total cumulative amount issued from 1997 to 2012.”

As I said nothing to see here….

US Capex

Posted by simonposullivan in Economics on June 25, 2014

In line with my post highlighting the falling trend in US GDP growth here is a graph showing US Capex starting to roll over. Durable goods growth is about to go negative too.

h/t Zerohedge

Zerohedge make the following claim:

Even assuming 3% growth in Q2, Q3 and Q4, full year US 2014 GDP will be 1.5% – the worst since 2009

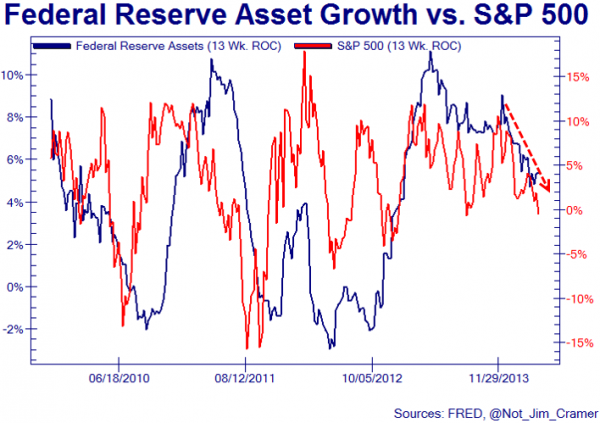

I think this validates the “QE hasn’t helped the real economy” argument. I do get/understand the counterfactual; what would have happened without QE. In truth we will never know – obviously – but I believe there has been too much monetary stimulus and not enough fiscal stimulus (which is more likely to put cash in the hands of consumers – as opposed it ending either sitting in bank reserves or being used as cheap funding by hedge funds to speculate)

Tapering

Posted by simonposullivan in Economics on April 14, 2014

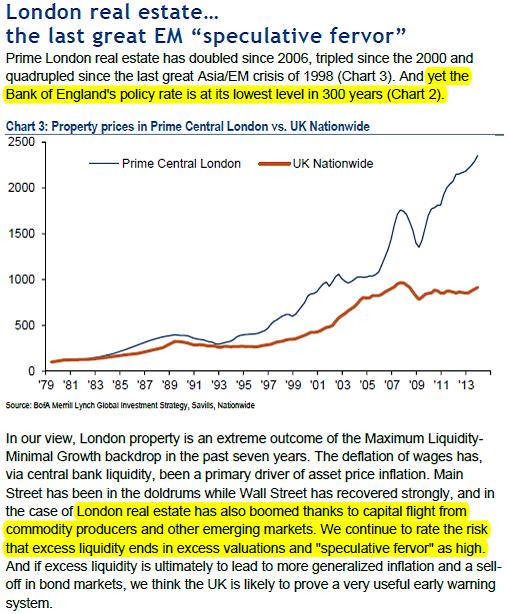

London Property

Posted by simonposullivan in Economics on March 28, 2014

Is London property in a classic bubble? It was certainly a sought after safe haven during the crisis for foreign (Russian, Italian, Greek etc) cash. At least with the UK you know you will always be repaid your capital (the UK can print money as it has its own Central bank unlike say Greece). A great graph from Merrill Lynch/BoA reproduced below:

Its hard to see a catalyst to bring this down to be honest – rising rates is too obvious. I had thought if the Eurozone crisis was finally over (I don’t think it is) capital might flow back to mainland Europe. It might be something else – the US freezing the oligarchs assets? Other buyers would probably come in to take their place. Perhaps yields simply becoming to low? An awful lot of London high end properties aren’t even rented out or used – the owners simply don’t need the income as they are so wealthy. Answers on a postcard….

Fed

Posted by simonposullivan in US Economy on January 29, 2014

Fed to emerging markets: “drop dead”

The Fed’s policy-making committee said in a statement Wednesday that it would trim its bond purchases to $65 billion per month in February, from a monthly pace of $75 billion in January.

QEeeeee

Posted by simonposullivan in Uncategorized on December 17, 2013

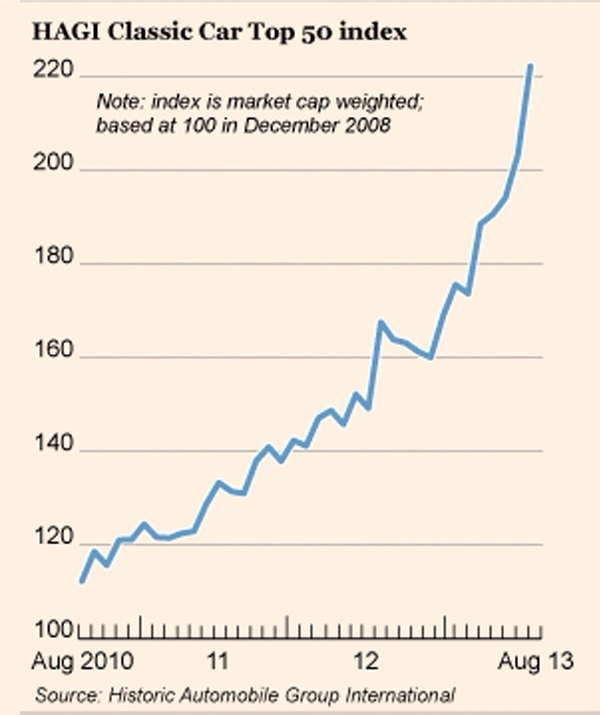

Classic cars

Posted by simonposullivan in Uncategorized on December 10, 2013

Here’s a ‘classic’ example of how QE is benefiting the very wealthy by pushing up prices of luxury items that the average Joe can only dream about.

QE Success

Posted by simonposullivan in Uncategorized on November 12, 2013

QE Again….

Posted by simonposullivan in Uncategorized on November 12, 2013

Wow

By Andrew Huszar, also posted at the WSJ. Mr. Huszar, a senior fellow at Rutgers Business School, is a former Morgan Stanley managing director. In 2009-10, he managed the Federal Reserve’s $1.25 trillion agency mortgage-backed security purchase program.

Confessions of a Quantitative Easer

We went on a bond-buying spree that was supposed to help Main Street. Instead, it was a feast for Wall Street.

I can only say: I’m sorry, America. As a former Federal Reserve official, I was responsible for executing the centerpiece program of the Fed’s first plunge into the bond-buying experiment known as quantitative easing. The central bank continues to spin QE as a tool for helping Main Street. But I’ve come to recognize the program for what it really is: the greatest backdoor Wall Street bailout of all time.

h/t Zerohedge

QE

Posted by simonposullivan in Uncategorized on October 23, 2013

As a follow up to the last post I forgot to mention that QE it seems is actually counterproductive

http://www.ritholtz.com/blog/2013/10/academic-studies-show-qe-doesnt-work/

Fed Policy Hasn’t Worked: 3 Academic Studies Show that Quantitative Easing Doesn’t Help the Economy

Quantitative easing doesn’t help Main Street or the average American. It only helps big banks, giant corporations, and big investors. (In reality, Federal Reserve policy works … just not for the average American. And a lot of the money goes abroad).

Lacy Hunt – former senior economist for the Federal Reserve in Dallas, chief economist for Fidelity Bank, chief U.S. economist for HSBC, and now Vice President of Hoisington Investment Management Company (with more than $5 billion under management) – writes today:

Academic studies indicate the Fed’s efforts are ineffectualAnother piece of evidence that points toward monetary ineffectiveness is the academic research indicating that LSAP [the Federal Reserve’s program of Large Scale Asset Purchases] is a losing proposition. The United States now has had five years to evaluate the efficacy of LSAP, during which time the Fed’s balance sheet has increased a record fourfold.

It is undeniable that the Fed has conducted an all-out effort to restore normal economic conditions. However, while monetary policy works with a lag, the LSAP has been in place since 2008 with no measurable benefit. This lapse of time is now far greater than even the longest of the lags measured in the extensive body of scholarly work regarding monetary policy.

Three different studies by respected academicians have independently concluded that indeed these efforts have failed. These studies, employing various approaches, have demonstrated that LSAP cannot shift the Aggregate Demand (AD) Curve. The AD curve intersects the Aggregate Supply Curve to determine the aggregate price level and real GDP and thus nominal GDP. The AD curve is not responding to monetary actions, therefore the price level and real GDP, and thus nominal GDP, are stuck—making the actions of the Fed irrelevant.

The papers I am talking about were presented at the Jackson Hole Monetary Conference in August 2013. The first is by Robert E. Hall, one of the world’s leading econometricians and a member of the prestigious NBER Cycle Dating Committee. He wrote, “The combination of low investment and low consumption resulted in an extraordinary decline in output demand, which called for a markedly negative real interest rate, one unattainable because the zero lower bound on the nominal interest rate coupled with low inflation put a lower bound on the real rate at only a slightly negative level.”

Dr. Hall also wrote the following about the large increase in reserves to finance quantitative easing: “An expansion of reserves contracts the economy.” In other words, not only have the Fed not improved matters, they have actually made economic conditions worse with their experiments. Additionally, Dr. Hall presented evidence that forward guidance and GDP targeting both have serious problems and that central bankers should focus on requiring more capital at banks and more rigorous stress testing.

The next paper is by Hyun Song Shin, another outstanding monetary theorist and econometrician and holder of an endowed chair at Princeton University. He looked at the weighted-average effective one-year rate for loans with moderate risk at all commercial banks, the effective Fed Funds rate, and the spread between the two in order to evaluate Dr. Hall’s study. He also evaluated comparable figures in Europe. In both the U.S. and Europe these spreads increased, supporting Hall’s analysis.

Dr. Shin also examined quantities such as total credit to U.S. non-financial businesses. He found that lending to non-corporate businesses, which rely on the banks, has been essentially stagnant. Dr. Shin states, “The trouble is that job creation is done most by new businesses, which tend to be small.” Thus, he found “disturbing implications for the effectiveness of central bank asset purchases” and supported Hall’s conclusions.

Dr. Shin argued that we should not forget how we got into this mess in the first place when he wrote, “Things were not right in the financial system before the crisis, leverage was too high [indeed], and the banking sector had become too large [exactly].” For us, this insight is highly relevant since aggregate debt levels relative to GDP are greater now than in 2007. Dr. Shin, like Dr. Hall, expressed extreme doubts that forward guidance was effective in bringing down longer-term interest rates.

The last paper is by Arvind Krishnamurthy of Northwestern University and Annette Vissing-Jorgensen of the University of California, Berkeley. They uncovered evidence that the Fed’s LSAP program had little “portfolio balance” impact on other interest rates and was not macro-stimulus. A limited benefit did result from mortgage-backed securities purchases due to the announcement effects, but even this small plus may be erased once the still unknown exit costs are included.

Drs. Krishnamurthy and Vissing-Jorgensen also criticized the Fed for not having a clear policy rule or strategy for asset purchases. They argued that the absence of concrete guidance as to the goal of asset purchases, which has been vaguely defined as aimed toward substantial improvement in the outlook for the labor market, neutralizes their impact and complicates an eventual exit. Further, they wrote, “Without such a framework, investors do not know the conditions under which (asset buys) will occur or be unwound.” For Krishnamurthy and Vissing-Jorgensen, this “undercuts the efficacy of policy targeted at long-term asset values.”

***

The Fed’s relentless buying of massive amounts of securities has produced no positive economic developments, but has had significant negative, unintended consequences.

For example, banks have a limited amount of capital with which to take risks with their portfolio. With this capital, they have two broad options: First, they can confine their portfolio to their historical lower-risk role of commercial banking operations—the making of loans and standard investments. With interest rates at extremely low levels, however, the profit potential from such endeavors is minimal.

Second, they can allocate resources to their proprietary trading desks to engage in leveraged financial or commodity market speculation. By their very nature, these activities are potentially far more profitable but also much riskier. Therefore, when money is allocated to the riskier alternative in the face of limited bank capital, less money is available for traditional lending. This deprives the economy of the funds needed for economic growth, even though the banks may be able to temporarily improve their earnings by aggressive risk taking.

Perversely, confirming the point made by Dr. Hall, a rise in stock prices generated by excess reserves may sap, rather than supply, funds needed for economic growth.

***

The money multiplier is 3.1. In 2008, prior to the Fed’s massive expansion of the monetary base, the money multiplier stood at 9.3, meaning that $1 of base supported $9.30 of M2.

If reserves created by LSAP were spreading throughout the economy in the traditional manner, the money multiplier should be more stable. However, if those reserves were essentially funding speculative activity, the money would remain with the large banks and the money multiplier would fall. This is the current condition.

The September 2013 level of 3.1 is the lowest in the entire 100-year history of the Federal Reserve. Until the last five years, the money multiplier never dropped below the old historical low of 4.5 reached in late 1940. Thus, LSAP may have produced the unintended consequence of actually reducing economic growth. [Indeed, 81.5% of money created through quantitative easing is sitting there gathering dust, due to a conscious decision by the Fed to tie up the money and prevent it from being loaned out to Main Street.]

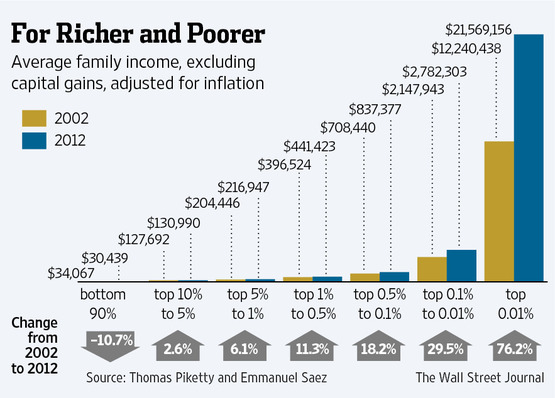

Stock market investors benefited, but this did not carry through to the broader economy. The net result is that LSAP worsened the gap between high- and low-income households. [Indeed, it’s been known for some time that quantitative easing quantitative easing increases inequality (and see this and this.)]

No wonder even former and current Fed officials have slammed the Fed’s policies over the last 5 years.