Posts Tagged London

London House Prices

Posted by simonposullivan in Uncategorized on June 4, 2014

As a general rule all bubbles appear justified at the time. It is only ex-post that it becomes clear that someone got suckered. who is it this time? all that Russian money fleeing Putin had to go somewhere. I hear anecdotally that the top end is coming off sharply in London. Only time will tell…..

London Property

Posted by simonposullivan in Economics on March 28, 2014

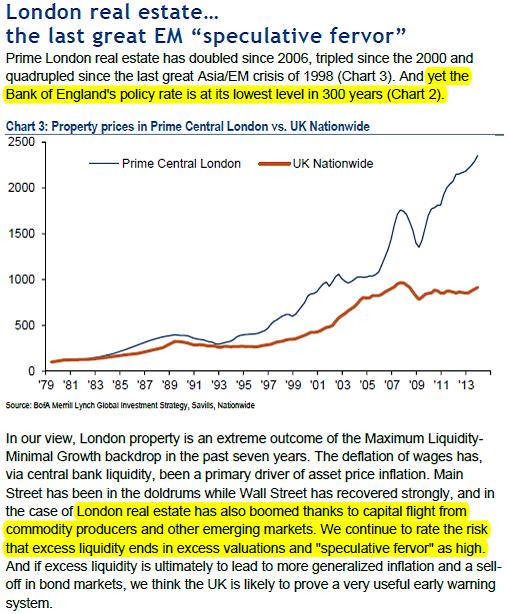

Is London property in a classic bubble? It was certainly a sought after safe haven during the crisis for foreign (Russian, Italian, Greek etc) cash. At least with the UK you know you will always be repaid your capital (the UK can print money as it has its own Central bank unlike say Greece). A great graph from Merrill Lynch/BoA reproduced below:

Its hard to see a catalyst to bring this down to be honest – rising rates is too obvious. I had thought if the Eurozone crisis was finally over (I don’t think it is) capital might flow back to mainland Europe. It might be something else – the US freezing the oligarchs assets? Other buyers would probably come in to take their place. Perhaps yields simply becoming to low? An awful lot of London high end properties aren’t even rented out or used – the owners simply don’t need the income as they are so wealthy. Answers on a postcard….

London

Posted by simonposullivan in Uncategorized on June 20, 2013

No blogging for a while as I was away in London for a few days meeting some fund managers and old friends from the City. It was very enjoyable as ever and intellectually very stimulating – I am lucky to have several extremely clever friends and past colleagues that I can debate and engage with on a wide variety of topics – though it inevitably ends up in a deep discussion about economics and financial markets, which I love.

Two things from the trip struck me – the first was the huge amount of building work going on the City – huge new gleaming office blocks towering into the sky. I met a few property specialists who couldn’t be sure they were fully let (or even half left) – as usual plenty of banks were taking space in the new-must-be-seen in building. Of course that means they moved out of somewhere else. This doesn’t chime with the stories we see almost daily of retrenchment in finance in London (and elsewhere) – RBS recently announced that some 2,000 investment banking jobs are to go (HSBC announced 13,000 layoffs globally a week ago ). It begs the obvious question if the flood of liquidity from QE is distorting the property market and storing up problems down the road (my suspicion is that it will be a problem – perhaps when the next equity bear market comes along – and if this is due to interest rates rising then hard hats on chaps).