Posts Tagged debt

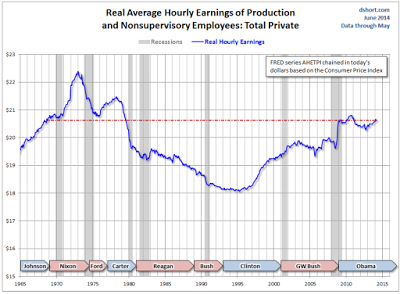

Wages in the US

Posted by simonposullivan in Economics, Uncategorized on June 19, 2014

Mish comments:

Congratulations to Republicans and Democrats alike. On a chained-dollar adjusted basis (but not counting sales taxes, property taxes, fees, home prices, etc.), real average hourly earnings are back to a level seen in 1968.

Counting taxes and fees, the average worker makes far less now.

Read more at http://globaleconomicanalysis.blogspot.com/2014/06/wages-vs-real-wages-over-time-how-fed.html#1iSDD3ydPGDsuqfc.99

Some chart…

This is very scary for those in debt. Exactly what has QE achieved?

Druckenmiller on QE: “the biggest redistribution of wealth from the middle class and the poor to the rich ever”

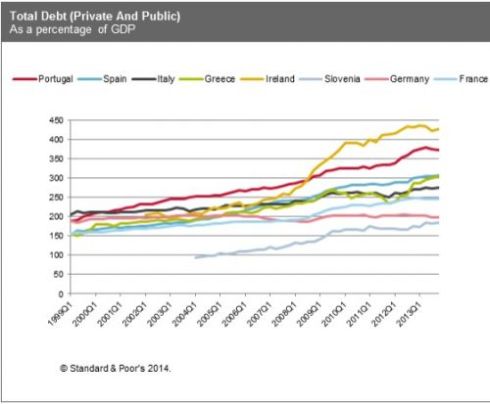

Irish Debt

Posted by simonposullivan in Uncategorized on June 19, 2014

Rather scary chart showing Irish debt among is the highest in the Western world

At end 2013, public and private non-financial sector debt was 499% of GNP (gross national product, which mainly excludes the profits of the significant foreign-owned sector), this compared with 304% in Greece; 300% in Spain; 266% in Italy and 201% in Germany.

h/t FinFacts

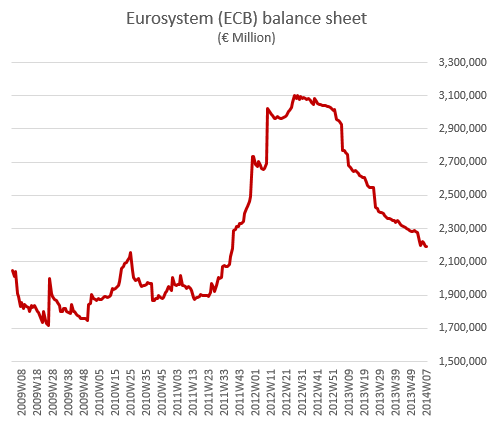

ECB

Posted by simonposullivan in Economics on March 10, 2014

The ECB balance sheet is contracting fairly sharply (and German PPI is actually negative) – very worrying given the debt levels. So the debate about deflation and falling prices continues – some economists actually think falling prices are a good thing (look at technology for example). However with massive amounts of debt then as prices fall the real value of the debt rises – exactly what Europe doesn’t need. The irony that the it’s the periphery with the largest debt is the very region that is being told by the bureaucrats to internally devalue to regain competitiveness.

Chinese Debt

Posted by simonposullivan in China on March 8, 2014

A Chinese Solar Panel manufacturer defaulted on its debt on Friday and it will be interesting to see if there is any fall out – some commentators are calling this China’s Bear (Stearns) moment – I am not so sure but its definitely worth watching. My view is still that there has been a massive bubble in Chinese debt – see below – that the authorities have to manage very very carefully.

China

Posted by simonposullivan in China on January 12, 2014

Via FT Alphaville some salient comments by Patrick Chovanec:

To those who wrote off China’s first banking seizure in June as a fluke, this latest episode [interbank lending market spiked to near 10 percent again last week] appeared to come out of nowhere. They cast about for explanations: Perhaps some seasonal surge in cash withdrawals was to blame, or the U.S. Federal Reserve’s decision to taper its bond-buying policy. Optimists assumed the PBOC was tightening credit on purpose, as a warning to banks to rein in unsafe lending practices. With inflation at manageable levels, they reasoned, the People’s Bank of China had plenty of room to loosen monetary policy again and ease the cash crunch.

In fact, loose monetary policy is the problem, not the solution. Two simple words — bad debt — are the key to understanding why China has too much money, yet not enough. In the years since the global financial crisis, China has racked up impressive growth in gross domestic product by engineering an investment boom, fueled by a surge in easy credit. Total debt has risen sharply, from 125 percent of GDP in 2008 to 215 percent in 2012. Credit has spiraled to $24 trillion from $9 trillion at the end of 2008. That’s an additional $15 trillion – – the size of the entire U.S. commercial banking sector — lent out in just five years.

A lot of that money has gone into projects whose purpose was to inflate the country’s economic statistics, not to generate a return. Officially, China’s banks report a nonperforming loan ratio of less than 1 percent. In reality, they are rolling over huge amounts of bad debt, both on their own books and by repackaging it into retail investment products — many of them extremely short-term — that promise ever higher rates of return

I have been worried for several year about Chinas investment boom, shadow banking and bad debts. I fear it will not end well – a five year bear market in a country’s stock market is not usually a positive sign

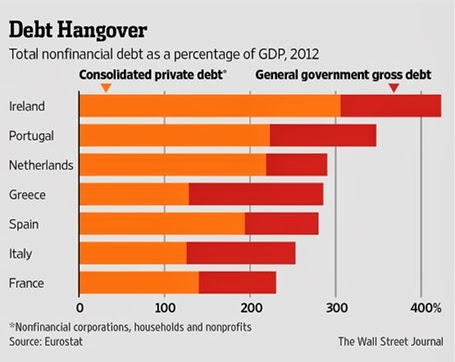

Irish Debt

Posted by simonposullivan in Ireland on January 9, 2014

As usual Seamus Coffey does some trojan work taking apart misleading newspaper articles. The first graph was on the website of The Wall Street Journal:

Seamus notes a lot of the corporate debt is not actually irish company debt:

Do Irish businesses have €330 billion in debt? Well, businesses in Ireland do, but not necessarily Irish businesses.

He adjusts the figures to come up with a more accurate number:

Here is a stab at end-2013 debt figures for the three sectors (estimated GDP: €165 billion)

SECTOR

DEBT, €bn

DEBT, %GDP

Households

€170bn

103%

Non-Financial Corporate*

€100bn

61%

Government

€200bn

121%

TOTAL

€470bn

285%

* Figure reflects “Irish” NFC debt of €40 billion lending to non-property-related sectors and property loans net of loss on NAMA transfers (these losses have already been counted in the gross debt of the Government sector) and similar losses outside the NAMA banks .

Frankly its still pretty brutal – if rates go up (and they won’t for a while but inevitably will) Ireland is in a whole lot of trouble (despite Mr Noonan being voted best Minister of Finance by the Banker magazine).

Great Depression

Posted by simonposullivan in Uncategorized on December 16, 2013

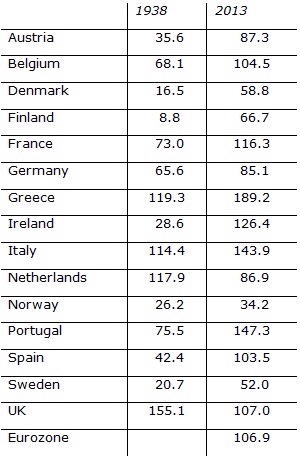

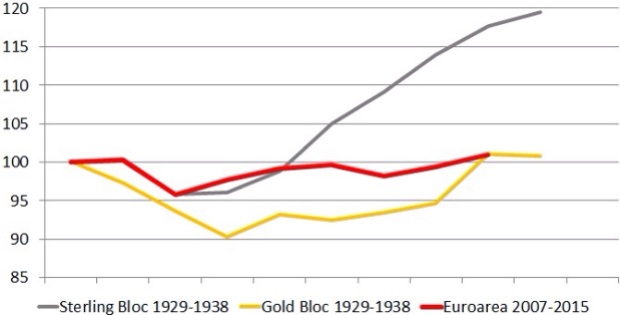

Here is a fascinating table that shows the total debt levels of European in 1938 – at the end of the Great Depression – were (generally) lower than today.

Also note how the sterling bloc which devalued grew quickly versus those countries that stayed on the gold standard and those in the euro straight jacket

H/T Nicholas Crafts, University of Warwick

Ukraine

Posted by simonposullivan in Uncategorized on October 17, 2013

If you’ve any assets in the Ukraine get them out FAST…..

Less reported than the travails of other EMs, the situation in Ukraine is nearing a tipping point. Ukraine is one of the most vulnerable EMs from the perspective of FX reserves (second chart). FX reserves are falling at an alarming 28% YoY rate (first chart). Meanwhile the repayments schedule to Ukraine’s international creditors looks daunting. Total external debt due for repayment over the next 12 months stands at around $62 billion, or 35% of GDP. Moreover, the likelihood is that much of the 2013 debt refinancing will be short term, leaving next year’s debt burden little better than this year’s.

h/t Varian Perception

There are still several countries in deep deep trouble Slovenia and Portugal spring mind as being in acute difficulties. Problems in Greece, Iceland and Cyrpus still haven’t been resolved. Even Ireland, “the poster child of austerity” to use that tired nomenclature beloved of European politicians, isn’t in the clear. We may be saying goodbye to the Troika shortly (with 25bn in cash on hand we are sorted for a year or so) but our banks are still in deep trouble as mortgage arrears continue to mount. If the Irish banks marked to market their mortgage books properly they would require even more capital – the question is where will they source it from?

US Debt

Posted by simonposullivan in Uncategorized on October 13, 2013

Interesting chart of US Debt showing Fed holding of 2 trillion. Note the large holding by China (this is actually far larger but they hold quite a lot of debt via London entities which obfuscates their true holding). As the Treasury owes the money to the Fed ie the govt owes the govt. it could just cancel this and voila debt ceiling issue resolved. Unorthodox? Sure, but isnt QE…….

Germany

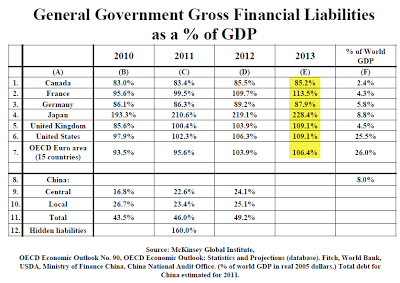

Posted by simonposullivan in Uncategorized on October 10, 2013

I was surprised how high German public debt is at 87.9%. Japan is off the scale -no surprise I guess to those of us who watch these things carefully. Be very careful of investing in Japan no matter what the bulls say. Japanese shares may look cheap on the surface but there are a lot of macro issues such as the aging population which combined with the high debt levels is toxic. Oh and as they try to weaken the yen via QE their imported energy costs shoot higher (good thing they weren’t forced to shut all their nuclear reactors then and rely on imported fuels isn’t it?. Eh…..)

h/t Lacy Hunt via Mish