Posts Tagged europe

Japan and Europe

Posted by simonposullivan in Economics on December 2, 2014

Simply been too busy in my day job to blog. This chart caught my eye. I’ve been thinking about the “Japanification of Europe” for a while now. Ten or twenty years of stagnation and deflation as global deleveraging and unwinding of the excesses built up pre-2008. Hopefully not but the bond market is starting to buy this theory.

Portugal

Posted by simonposullivan in Economics on July 11, 2014

Is this a canary in the coalmine or just a minor speedbump. the world is very complacent so this merits careful consideration:

h/t Chris Bailey

George Soros

Posted by simonposullivan in Economics on June 26, 2014

Interesting interview with Soros here. He thinks the euro crisis is over – I’m not 100% convinced but the denouement has certainly been postponed. His idea re eurobonds seems to have caught on by another name (European project bonds). Hard to argue with fiscal support – monetary policy has reached its limits (and as my previous posts show it hasn’t really helped US growth recently)

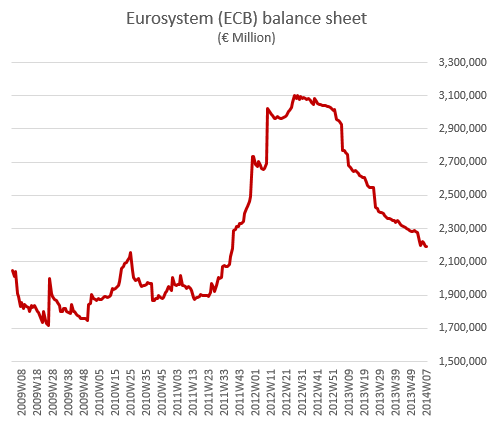

ECB

Posted by simonposullivan in Economics on March 10, 2014

The ECB balance sheet is contracting fairly sharply (and German PPI is actually negative) – very worrying given the debt levels. So the debate about deflation and falling prices continues – some economists actually think falling prices are a good thing (look at technology for example). However with massive amounts of debt then as prices fall the real value of the debt rises – exactly what Europe doesn’t need. The irony that the it’s the periphery with the largest debt is the very region that is being told by the bureaucrats to internally devalue to regain competitiveness.

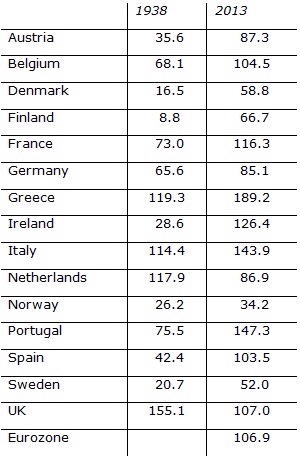

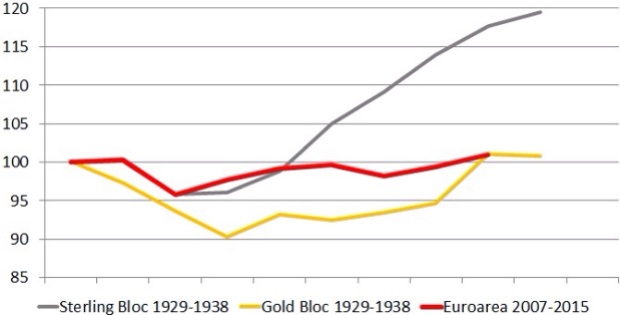

Great Depression

Posted by simonposullivan in Uncategorized on December 16, 2013

Here is a fascinating table that shows the total debt levels of European in 1938 – at the end of the Great Depression – were (generally) lower than today.

Also note how the sterling bloc which devalued grew quickly versus those countries that stayed on the gold standard and those in the euro straight jacket

H/T Nicholas Crafts, University of Warwick

PIGS

Posted by simonposullivan in Uncategorized on October 6, 2013

So much for the revival of industrial production in the periphery- not much evidence here. The IP numbers in Germany, the UK and France have been a bit better but likely a result of large orders from the biannual Paris air show and inventory build in the auto sector. German IP data has been revised downwards lately.

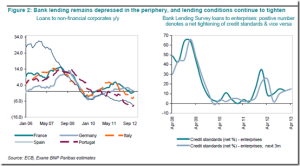

The following charts show the importance of credit growth to European GDP growth. Credit growth is stagnant – not a good sign.

Germany

Posted by simonposullivan in Uncategorized on August 24, 2013

Ah those canny Germans- two silver medals in two wars and still they come out on top…..

Profiteering: Crisis Has Saved Germany 40 Billion Euros

Germany has profited from the euro crisis to the tune of 41 billion euros in reduced interest payments. Strong demand for its debt has cut yields and made it cheaper for Germany to borrow. Meanwhile, the crisis has only cost Germany a mere 599 million euros thus far.

According to figures made available by the Finance Ministry, Germany will save a total of €40.9 billion ($55 billion) in interest payments in the years 2010 to 2014. The number results from the difference between actual and budgeted interest payments.

Debt and Austerity in Europe

Posted by simonposullivan in Uncategorized on August 6, 2013

Austerity just isn’t working. Ive long felt there are no good choices here – just bad choices and worse choices. But something needs to be done about the surge in unemployment in the PIIGS especially youth unemployment.

h/t Matt Philips at Quartz

European Unemployment

Posted by simonposullivan in Uncategorized on May 29, 2013

Pretty awful chart below highlighting the desperate state of European youth unemployment. The will have very long-term damaging consequences if it is not sorted out and reversed quickly. I have little faith in the ability or willingness of our champagne quaffing, chaffeur driven, overly-superannuated leaders to tackle this

Bank Lending

Posted by simonposullivan in Uncategorized on March 3, 2013