Posts Tagged overvaluation

S&P Returns

Posted by simonposullivan in Equities on February 13, 2014

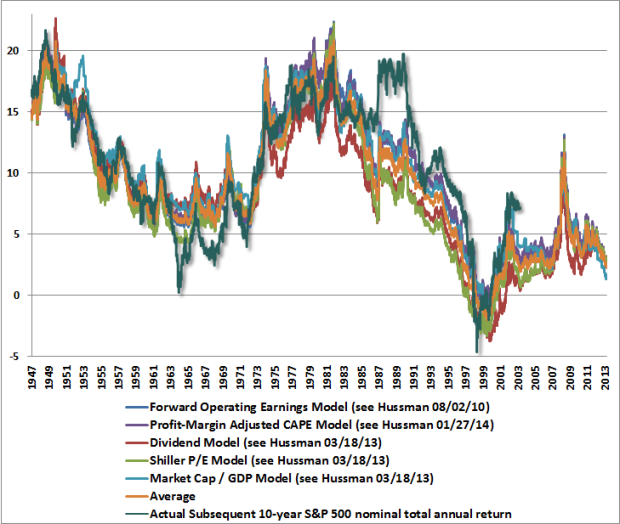

The usual enlightening chart from John Hussman showing clearly that the expected returns from equities over the next ten years are in the 2-4% per annum range. Given the S&P 500 yields about 2% this implies the S&P will be around its current level. How it gets there is another question. Yes it could rocket up another 25% easily but its likely to collapse thereafter. At the end of Jan I’ve moved my pension fund from 100% equities to 100% cash – I simply think the risk/reward in this market is very skewed to the downside.

I urge you to read the full article NOW

http://www.hussmanfunds.com/wmc/wmc140203.htm

Balanced Portfolios

Posted by simonposullivan in Uncategorized on December 12, 2013

For those of you who believe in mean reversion (I do) the following chart does not look promising in terms of future returns from here: